Corporate Tax Return Due Date 2024 India

Corporate Tax Return Due Date 2024 India. Stay updated with these important dates to maintain. The income tax department’s website shows that 3.58 crore itrs have been filed as of july 19, marking an 11% increase compared to the same.

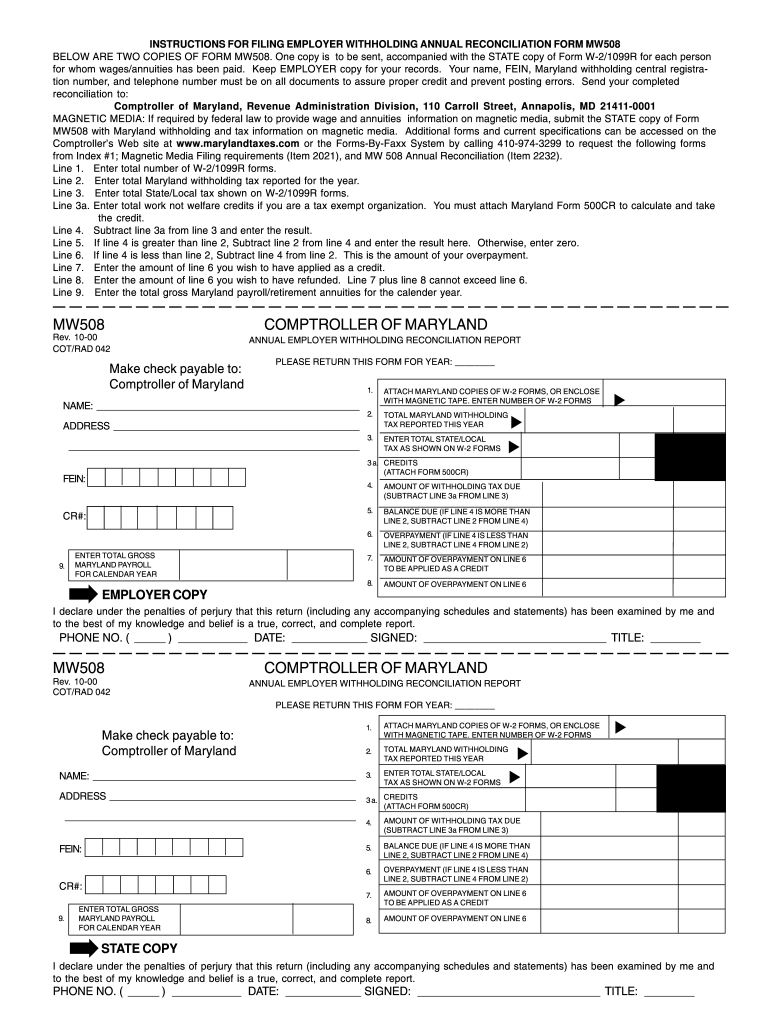

What happens if a company does not file itr? Clause 26 of form 3cd requires tax auditors to report on sums incurred and paid under section 43b of the income tax.

Corporate Tax Return Due Date 2024 India Images References :

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: toriyroxana.pages.dev

Source: toriyroxana.pages.dev

2024 Quarterly Tax Payment Dates In India Lesya Rodina, If you’re a c corporation or llc electing to file your taxes as one for 2023, your corporate tax return is due on april 15th, 2024—unless.

Source: concettinaweartha.pages.dev

Source: concettinaweartha.pages.dev

Corporation Due Date 2024 Betta Charlot, July 7 is the due date to deposit of tax deducted or collected for the month of june 2024.

Source: hannisyjuline.pages.dev

Source: hannisyjuline.pages.dev

Last Day For Taxes 2024 India 2024 Hana Karisa, Last date for filing income tax returns in india 2024.

Source: fayinaqnancee.pages.dev

Source: fayinaqnancee.pages.dev

What Is The Due Date For Tax Returns For 2024 Elaina Stafani, Tax audit checklist on clause 26 and 27 of form 3cd under the income tax act, 1961.

Source: carta.com

Source: carta.com

Business Tax Deadlines 2024 Corporations and LLCs, Nine months after the date of the company's financial year end).

Source: rosalindwfarica.pages.dev

Source: rosalindwfarica.pages.dev

Last Day For Filing Taxes 2024 Darya Emelyne, Stay updated with these important dates to maintain.

Source: laceybsteffi.pages.dev

Source: laceybsteffi.pages.dev

April 2024 Gst Due Date India Alaine Shelley, In fact, the corporate tax rates in india are already above the global minimum corporate tax rates of 15% prescribed under pillar two.

Source: annadianewminne.pages.dev

Source: annadianewminne.pages.dev

Corporate Return Due Date 2024 Joete Lynsey, If you’re a c corporation or llc electing to file your taxes as one for 2023, your corporate tax return is due on april 15th, 2024—unless.

Source: corporatetaxreturnprep.com

Source: corporatetaxreturnprep.com

January 2024 Business Due Dates Corporate Tax Return Prep, This article offers a comprehensive guide to key due dates for gst, income tax, and roc compliance.

Source: www.forbesindia.com

Source: www.forbesindia.com

ITR Filing Last Date For FY 202324 (AY 202425) Due Dates For, This article offers a comprehensive guide to key due dates for gst, income tax, and roc compliance.

Posted in 2024